M due to uncertainties over the timing and magnitude of the Fed's monetary policy tightening agenda, Apple will likely draw a rebound from Thursday's earnings call. While lost revenues driven by COVID- and supply-chain-related disruptions are likely a given, the tech giant is expected to have set a new record for fiscal first quarter sales on strong holiday season demand, nonetheless. Recent observations of easing supply chain constraints across Apple's suppliers and manufacturing partners also signal improvements to the current year sales outlook, which bolsters investors' confidence in the stock. And the continued strength in demand for Apple's products and services will likely maintain the brand's pricing power to beat any persisting inflation pressures ahead. Narrow-moat Apple reported stellar fiscal first-quarter results that came in substantially ahead of our estimates despite supply chain constraints and the ongoing chip shortage. Demand for the firm's latest iPhone 13 and MacBook Pro drove record iPhone and Mac revenue for the December quarter.

We remain positive on Apple's ability to extract sales from its installed base via new products and services. Market Cap is calculated by multiplying the number of shares outstanding by the stock's price. To calculate, start with total shares outstanding and subtract the number of restricted shares.

Restricted stock typically is that issued to company insiders with limits on when it may be traded.Dividend YieldA company's dividend expressed as a percentage of its current stock price. While some are bracing for an aggressive dose of monetary policy tightening with an initial rate hike of up to 50 bps in March to rein in inflation, the Fed will likely tread lightly over the matter. Despite historical inflation, it's likely the Fed is "acutely aware of the risk around getting too aggressive" and making a policy mistake that could be detrimental to the economy. As for Apple, the tech giant is expected to deliver an update that will likely encompass strong holiday season sales and robust demand for its products and services, despite protracted supply chain constraints being the near-term overhang.

Apple also appears to be getting more Android customers to migrate to its ecosystem, noting that it saw strong double-digit growth in the number of people who switched in Q3. This is significantly positive, as Apple has done a good job locking in users and better monetizing them with pricier upgrades, new products, and services. While continued revenue growth and solid margin expansion should drive Apple's profits, shareholder returns could be magnified by Apple's massive stock buyback program. For perspective, the company has bought back an average of 5% of its stock each year over the last five years. Apple has proven successful in both its product offerings and performance in its respective industry.

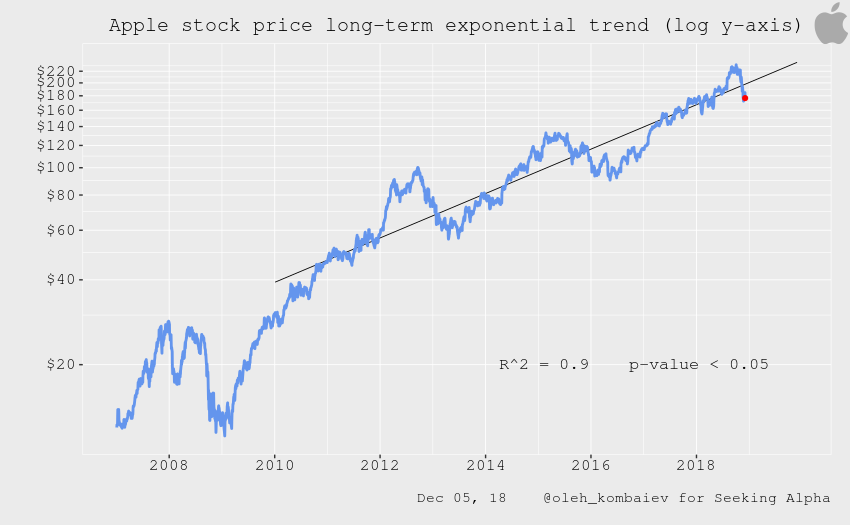

In addition to being the first publicly traded U.S. company to reach a trillion-dollar valuation in 2018, the company also maintains strong financials with widespread media recognition. As a reliably successful publicly traded companies, Apple also retains blue-chipstatus. However, stocks can be volatile, so it's wise to choose carefully before investing. As discussed in our previous coverage, Apple remains a top hedge against mounting macro headwinds like inflation and rate hikes. The stock's latest pullback also puts its current trading multiples at a small discount compared to those during last year's February tech stock sell-off.

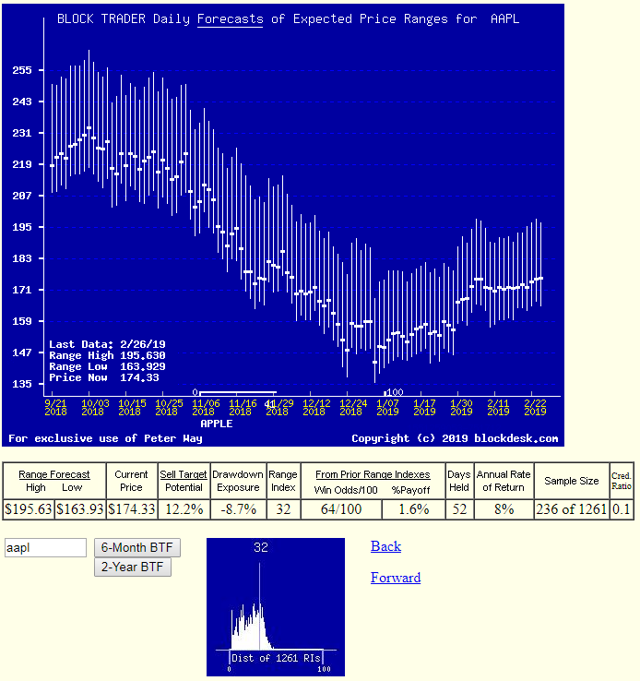

It's currently trading at about 28.8x TTM earnings compared to above 30x at the onset of 2021's early-year sell-off. Apple Inc. is a technology company that specializes in computer software, electronics, media devices and online services. Founded in 1976 by Steve Jobs and Steve Wozniak in Cupertino, California, the company now offers its products all around the world.

In addition, Apple was the first publicly-traded U.S. company to reach a trillion dollar valuation. Given that consumers worldwide know and trust the company, investors, both new and experienced, are widely interested in buying equity in Apple. Below, we take a closer look at how to become an Apple shareholder. If you want further hands-on guidance with your investing strategy, consider enlisting the help of a trusted financial advisor. Paired with the stock's recent pullback in price, we're maintaining a buy rating with expectations for it to contest the $200-level within the next 12 months.

On August 13, 2020, Epic Games, the maker of the popular game Fortnite, sued Apple and Google after its hugely popular video game was removed from Apple and Google's App Store. The suits come after both Apple and Google blocked the game after it introduced a direct payment system, effectively shutting out the tech titans from collecting fees. In September 2020 Epic Games founded the Coalition for App Fairness together with other thirteen companies, which aims for better conditions for the inclusion of apps in the app stores.

Later in December 2020, Facebook agreed to assist Epic in their legal game against Apple, planning to support the company by providing materials and documents to Epic. Facebook had, however, stated that the company will not participate directly with the lawsuit, although did commit to helping with the discovery of evidence relating to the trial of 2021. In the months prior to their agreement, Facebook had been dealing with feuds against Apple relating to the prices of paid apps as well as privacy rule changes. Customers who value support You can also use a brokerage account to invest in a mutual fund or exchange-traded fund that invests in Apple. Look for funds that focus on the technology sector or on large cap stocks.

Buying shares in a mutual fund or ETF lets you invest in Apple while also investing in a number of other companies, giving you diversification and protecting your investments against any downturns from a single stock. Texas Instruments, the world's largest producer and supplier of analog and embedded processing chips, and a key supplier of display parts to Apple, has provided a stronger-than-expected sales and profit forecast during Tuesday's earnings call. The semiconductor giant also reported slight improvements to inventory levels, albeit still about 40% lower than normal, as well as lower volumes of expedited order requests. These items, together, suggest that the ongoing chip supply shortage may be finally starting to ease. The expected trend is further corroborated by recent announcements from Hon Hai Precision Industry, the key assembler of Apple's iPhones.

Hon Hai's Chairman Young Liu is predicting "unprecedented performance in the first quarter" that will surpass historical output levels. The global leader in contracted consumer electronics manufacturing is gearing up to ensure adequate levels of inventory for customers this quarter, including Apple, to prevent further unravelling of supply chain disruptions. At 28 times earnings and with 3% buyback per year at a progressive rate, that's about 40% increase in share price even if they didn't grow . It also doesn't count what'll likely amount to a buck a share average dividend annually. Apple stock rose by 0.9% in trading this morning, but closed down 2.1%, at $175.74 per share.

Talk of the $3 trillion mark came as JPMorgan updated its target share price for the company from $180 to $210, citing improved expectations around demand for the iPhone 13. Apple told suppliers earlier this month demand for the new phone had weakened, but iPhone sales in China were up by more than 6% in November compared to the previous year, boosting analysts' confidence in the stock. In a note, JPMorgan analysts wrote they believed Apple's stock was undervalued, and that the company's upcoming iPhone with 5G technology has the potential to convert more than 1 billion Android users. Apple briefly became the world's first $3 trillion company today based on market capitalization, which is the total value of all of the company's outstanding shares. The milestone came after Apple's stock price rose over 40% in the last year.

The impressive feat, which Apple achieved when its stock price reached the $182.86 mark during intraday trading, came just over 16 months after Apple be... MarketBeat empowers individual investors to make better trading decisions by providing real-time financial data and objective market analysis. Whether you're looking for analyst ratings, corporate buybacks, dividends, earnings, economic reports, financials, insider trades, IPOs, SEC filings or stock splits, MarketBeat has the objective information you need to analyze any stock. The iPhone 13 remains the dominant 5G-enabled mobile device on the market.

It was the most sought-after product during the holiday season, and remains so today even as inventories begin to return to normal levels. Some regions are reporting wait times of up to a full week for online iPhone 13 orders to arrive due to the ongoing clash between robust demand and squeezed supply. While Apple is in process of restoring balance across its supply of the iPhone 13, its core revenue driver among other products, it is also continuously working on improving its product roadmap. Apple stock is now standing in a unique position in terms of timing, with Fed Chair Jerome Powell to give an update on monetary policy decision on Wednesday and the tech giant's corporate earnings release on Thursday. On one hand, Wednesday's briefing from Powell could lead to further market volatility as investors brace for an announcement on the timing and magnitude of upcoming rate hikes. On the other hand, Apple's results and outlook to be released on the following day could come in strong and save the day by reversing the dire sentiment over the technology sector.

Whether you realize it or not, stock market corrections, and even crashes, are an inevitable part of the investing cycle. According to a select group of analysts and investment banks, the latest correction could yield massive upside for a trio of supercharged growth stocks. If Wall Street's high-water price targets come to fruition, these fast-paced companies could rocket higher by 126% to as much as 248% over the next 12 months. The stock is now trading at 28 times earnings, and a similar multiple after 10 years would translate into a stock price of $980 based on the company's estimated earnings mentioned above.

That means Apple stock could rise nearly 470% over the next decade from its closing price of $172 on Feb. 11, which is why it would be a good idea for investors to continue holding this tech stock, as it seems built for more upside. On August 20, 2012, Apple's rising stock price increased the company's market capitalization to a then-record $624 billion. This beat the non-inflation-adjusted record for market capitalization previously set by Microsoft in 1999. On August 24, 2012, a US jury ruled that Samsung should pay Apple $1.05 billion (£665m) in damages in an intellectual property lawsuit. Samsung appealed the damages award, which was reduced by $450 million and further granted Samsung's request for a new trial. On November 10, 2012, Apple confirmed a global settlement that dismissed all existing lawsuits between Apple and HTC up to that date, in favor of a ten-year license agreement for current and future patents between the two companies.

It is predicted that Apple will make $280 million a year from this deal with HTC. On January 14, 2009, Jobs announced in an internal memo that he would be taking a six-month medical leave of absence from Apple until the end of June 2009 and would spend the time focusing on his health. Though Jobs was absent, Apple recorded its best non-holiday quarter during the recession with revenue of $8.16 billion and profit of $1.21 billion. As the market for personal computers expanded and evolved throughout the 1990s, Apple lost considerable market share to the lower-priced duopoly of the Microsoft Windows operating system on Intel-powered PC clones (also known as "Wintel").

In 1997, weeks away from bankruptcy, the company bought NeXT to resolve Apple's unsuccessful operating system strategy and entice Jobs back to the company. Jobs resigned in 2011 for health reasons, and died two months later. Whether you should purchase a share of Apple depends largely on your financial goals. With a 52-week high stock price of $233.47, and a low of $142.00, Apple has consistently demonstrated strong financials.

However, you'll also want to accept the risk that comes with every investment. Though Apple has earned blue-chip status, its stocks are nonetheless susceptible to decline. Therefore, when making investments, it's critical to spend no more than you can afford to lose.

It can pay back dividends or buy back shares, giving investors a chance to actualize a return on their investments. But in order for that to be valuable, Apple has to keep going up. Sometimes a dividend or a share repurchase program helps with that, but for the most part it has to keep convincing investors that it's going to continue to grow. If that happens, Wall Street's happy — and Apple can keep doing what Apple wants to do. Last quarter, Apple fell just under what industry watchers were expecting — and everyone was curious if it would do it again, which it did. That's the second straight quarter where it's missed what Wall Street was seeking.

Apple has historically been one of the strongest and most consistent growth stocks in not only the technology sector, but also the world. It's basically a bellwether for the technology industry — if Apple is doing poorly, something must be wrong. But in the recent quarter, it becomes increasingly apparent that its growth engine — the iPhone — is stalling. We sell different types of products and services to both investment professionals and individual investors.

These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. Apple Inc. is a global technology company that designs, manufactures, and sells smartphones, personal computers, tablets, wearables, and accessories. However, demand definitely remains robust, which underscores the tech giant's continued dominance across the market segments in which it operates in. And the company's management team has clearly done a good job in ensuring demand remains in their pockets despite the current shortfall in supply.

These, together, are all positive signs that the company's valuation prospects remain intact. In its fiscal year ending in September 2011, Apple Inc. reported a total of $108 billion in annual revenues—a significant increase from its 2010 revenues of $65 billion—and nearly $82 billion in cash reserves. On March 19, 2012, Apple announced plans for a $2.65-per-share dividend beginning in fourth quarter of 2012, per approval by their board of directors. Apple has gradually expanded its efforts in getting its products into the Indian market.

Why Is Apple Doing So Well In Stocks In July 2012, during a conference call with investors, CEO Tim Cook said that he " India", but that Apple saw larger opportunities outside the region. India's requirement that 30% of products sold be manufactured in the country was described as "really adds cost to getting product to market". In May 2016, Apple opened an iOS app development center in Bangalore and a maps development office for 4,000 staff in Hyderabad. In April 2019, Apple initiated manufacturing of iPhone 7 at its Bengaluru facility, keeping in mind demand from local customers even as they seek more incentives from the government of India. At the beginning of 2020, Tim Cook announced that Apple schedules the opening of its first physical outlet in India for 2021, while an online store is to be launched by the end of the year.

For what it's worth, the legendary investor Warren Buffett is still betting on Apple—despite his general reluctance to invest in technology companies. Buffett said back in May that his holding company, Berkshire Hathaway, has 9.8 million shares of Apple. If that's still the case, several market watchers have pointed out, the recent uptick in Apple's value means Berkshire Hathaway likely made more than $60 million off the investment in a single day last week. Currently, the company is expected to earn $55 a share next calendar year. Even at the current stock price of $636, that's a P-E on 2013 earnings of 11.5. That's actually slightly cheaper than the 12.6 P-E on the S&P 500, based on estimated 2013 earnings.

Furthermore, Apple just started paying a dividend and yields 1.6%, just behind the 1.9% yield of the S&P 500. Apple will report its earnings results for the fourth quarter of 2021 on Thursday, and it could be the best quarter in the company's history. Wall Street analysts on average estimate that Apple will report revenue of $118.3 billion for the quarter, according to Yahoo Finance. This figure would be an all-time quarterly revenue record for Apple, topping the $111.4 billion that it earned in the ... The stock market gains come ahead of Apple's third quarter earnings results, which will be reported on July 27. Apple unveiled several new products during the quarter, including the AirTag and new models of the iPad Pro, iMac, and Apple TV in April, and previewed major new software updates like iOS 15 and macOS Monterey at WWDC in June.

The global push for 5G adoption and Apple's aging installed base of iPhones is also expected to drive the segment into one of the largest multi-year upgrade cycles ahead. While Apple's fiscal second quarter has historically experienced slower sales compared to the fiscal first quarter due to seasonality, recent improvements to supply chain will likely drive a boost in sales. Paired with in-store observations of replenished iPhone stock and the expectation for returning customers looking to cash in their gift card rebates received over the holidays, a stronger-than-expected outlook for the year is likely in order. Supply chain constraints are clearly still a theme for Apple. And it seemed to have been accentuated over the December-quarter – its best sales quarter of the year – when most wanted to get their hands on the most advanced mobile and computing devices, and complementing accessories and gadgets. Consumer willingness to endure long wait times through online orders are also testament to continued strength in demand for Apple's products.

Investors should also note the shareholder-friendly ways that Apple is deploying its net cash position of $66 billion and its annualized free cash flow of $93 billion. Apple returned about $24 billion to shareholders during its fiscal fourth quarter, with $3.6 billion of this sum going to dividends and $20 billion to open-market purchases of its stock. By repurchasing shares, of course, Apple is reducing its total share count and increasing the stake of each share in its business. Investors who take time to look into the fundamentals of Apple's business will quickly realize that there's a lot to like. Circling back to the company's most recent earnings report, Apple demonstrated soaring revenue and earnings per share.

Revenue in the period jumped 29% year over year to $83.4 billion, and earnings per share increased from $0.73 in the year-ago period to $1.24. Further, Apple saw record revenue in every one of its geographic and product segments. As Apple Inc. shares hit an all-time high this week with its largest gains in nearly six months, investors are left wondering if it's worth buying the tech giant at this point, or whether it can edge higher still. He acknowledges that people are wishing for the "excitement of revolution", but argues that people want "the comfort that comes with harmony".

At Apple, employees are intended to be specialists who are not exposed to functions outside their area of expertise. Jobs saw this as a means of having "best-in-class" employees in every role. For instance, Ron Johnson—Senior Vice President of Retail Operations until November 1, 2011—was responsible for site selection, in-store service, and store layout, yet had no control of the inventory in his stores. This was done by Tim Cook, who had a background in supply-chain management. Each project has a "directly responsible individual" or "DRI" in Apple jargon.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.